Years of deficits are a sign of a structurally sick Victorian budget and long-term plans to fix it are reactive, the state’s financial watchdog has warned.

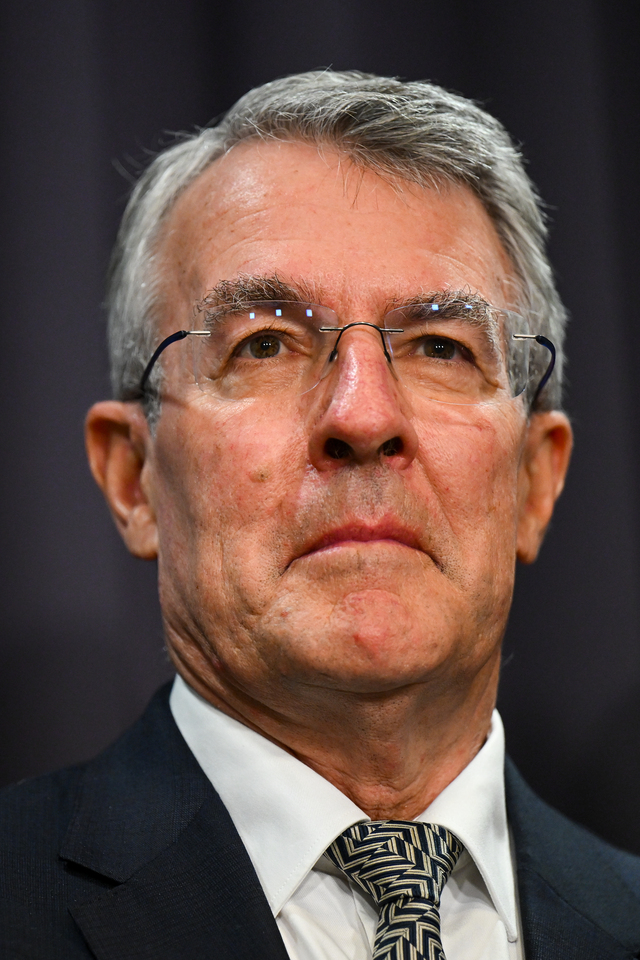

Auditor-General Andrew Greaves has sounded the alarm about “structural issues” in his 2023/24 annual financial report into the state after the government sector posted another operating loss of $4.2 billion.

It was the eighth consecutive year the Victorian Labor government spent more money than it raised, with a fiscal cash deficit of $14.4 billion.

The result pushed total losses to $48 billion in the past five years, $31.5 billion of which the government blamed on its response to the COVID-19 pandemic and $16.5 billion on providing public services.

But Mr Greaves signalled the repeated outcome was symptomatic of bigger and broader problems.

“Ongoing operating losses and fiscal cash deficits are indicators of structural issues with underlying revenue and expenditure policy settings that create risks to financial sustainability,” the report tabled in parliament on Friday said.

Gross government sector debt outpaced revenue and economic growth to top $168.8 billion and was projected to reach $228.2 billion by mid-2028.

Interest repayments on the ballooning debt jumped $1.7 billion from new or refinanced borrowings at higher interest rates.

The higher interest bill, growing public sector employee wages and other costs including the $380 million 2026 Commonwealth Games settlement pushed operating expenses $3.7 billion higher.

The auditor-general’s office said interest expenses now made up 6.1 per cent of operating revenue and were expected to soar to 8.8 per cent by 2027/28.

The Allan government has committed to reducing net debt levels, relative to a percentage of the state’s economy by 2027/28 with $4.9 billion in cost-saving initiatives across the next four years.

“Achieving these savings and maintaining current service levels will be challenging given several emerging financial risks,” the report said.

Mr Greaves said current strategies were short-term, reactive and did not address both the existing financial challenges and emerging financial risks.

Assistant Treasurer Danny Pearson rejected his claim and another that structural issues in the budget could jeopardise the delivery of essential services.

“I like Andrew personally but I don’t agree with his report,” he told reporters outside Treasury Place.

“We’ve got a really strong, vibrant economy here in Victoria.”

Opposition Leader John Pesutto said the report was a damning verdict on the Labor government’s debt record.

“Nearly 10 per cent of every dollar raised in revenue will be going simply to pay interest – that’s not acceptable,” he said.